By Michael Burke

The outcome of the EU summit has widely been hailed in the British media as a triumph for David Cameron. It is rare that a complete rupture and isolation in multi-party negotiations is regarded as a triumph – but this is a function of the dominant and still growing xenophobia of the British press.

The EU Commission will now impose further spending cuts and rules to enforce deficit limits across the whole of the EU. David Cameron did not oppose these measures because they lead to public spending cuts- he is cutting public spending by a greater proportion of GDP than any major country which has not been in receipt of EU/IMF funds for its creditors.

Cameron’s stated objective was a defence of the interests of the City of London. There is a question mark over whether he has even be able to achieve that. Angela Knight, former Tory MP and chief spokesperson for the British Bankers Association guardedly told The Times that she hoped that City’s interests would not be harmed by Britain’s isolation.

Holding Back the Tide

‘Let all men know how empty and powerless is the power of kings’. So said King Canute in demonstrating to sycophantic courtiers the impossibility of instructing the advancing tidewaters to retreat. But it seems that the thinking of the EU Commission has retreated behind even that of Dark Age monarchs.

In response to the economic, fiscal and balance of payments crises in Europe, the EU summit in Brussels agreed to issue a series of regulations- to prevent these crises being manifest at the level of government deficits. A new rule that so-called structural deficits will not exceed 0.5% of GDP has been introduced . The EU Commission will be given prior oversight of the national Budgets. Given the impossibility of factually establishing the level of the structural deficit (which depends on extremely approximate estimates of potential output) then the combination is a recipe for complete control by the EU Commission - the economic geniuses who have led Greece and Ireland to disaster.

While it is impossible to precisely quantify the structural deficit it is practically impossible to determine the level of the government deficit simply by controlling spending. This is because the deficit reflects the gap between government spending and income. Government incomes are overwhelmingly taxation revenues and these are determined by the spending of consumers and the spending of businesses (primarily investment).

To achieve the precise control over its own income, as demanded by the new agreement, the European governments would have to determine the incomes and spending of both other main sectors of the economy, consumers and businesses. And, in a currency union it would also have to ensure that the overseas sector was not a significant net lender or borrower (through large trade or current account deficits/surpluses). Otherwise, if the other domestic sectors remained in broad balance, a large trade deficit could only result in a large government deficit.

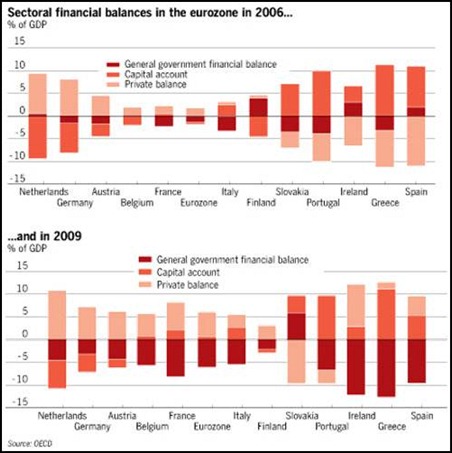

This is show in Figure 1 below. The chart shows the sectoral balances in leading EU economies and the EU as well as the change between 2006 and 2009. The chart is taken from the Financial Times and is based on OECD data.

Figure 1

Simple national accounting identities mean that the increased savings of one sector of the economy must be reflected in the increased deficit of another. In all cases the balances shown below, the government balance (the public sector deficit/surplus), the private sector balances (the savings/consumption of the private sector) and the overseas sector (the current account balance) sums to zero, as they must.

Within each national economy of the EU it is impossible to legislate for the deficit of the public sector without determining the savings, consumption and investment decisions of all other sectors of the economy.

It is also entirely impossible in a single currency area for all other economies to maintain government balances if one or more key countries have large current account surpluses, as is presently the case with Germany and others. Other countries must then run current account deficits and to simultaneously maintain a government balance they are faced with two unacceptable alternatives. They must either hugely increase household savings even though incomes are declining; that is, household spending must fall even faster than incomes. Alternatively, businesses must reduce investment to well below the level of its income, which could only lead to a further reduction in competitiveness and a renewed widening of the current account deficit. This is the downward spiral that countries like Greece have already entered.

The Tory Position

David Cameron did not object to any of this because he is a champion of increased government spending, or a defender of the welfare state. Nor has his government shown any appreciation of the fact that reduced government spending will also reduce the incomes of other sectors of the economy.

Instead, his objection was to the threat to the City’s ability to siphon off funds from other businesses in Europe. He may not have been successful even in that limited aim. Ed Miliband writing in the Evening Standard argued that Cameron was ‘a prisoner of the Tory Right’ and had isolated himself and Britain from the continuing evolution of policy in Europe.

While willing the other EU national leaders to act decisively to halt the crisis, Cameron himself acted to prevent that happening. Defending the sectional interest of the City and relying on some of the most backward political forces in Britain, Cameron has finally crossed a line that even Thatcher only threatened to do. There will be no benefit to the British economy from this decision and the consequences could prove extremely negative. If, for example, overseas multinationals decide they want a base in the EU, will they choose semi-detached Britain or one of the other 26 countries who continue to have a common regulatory regime? If the British economy suffers as a result, it should be remembered this was done to benefit the City of London and to appease the Tory Eurosceptics and Union Jack-wavers.

No comments:

Post a Comment