By Michael Burke

The Autumn Statement was widely presented as facing up to harsh realities of slower growth, but with George Osborne offering a series of cunning schemes in order to resolve the crisis .

The stagnation of the British economy is a function of government policy and plans to increase investment by increasing the credit available to smaller firms will founder because they will not invest when they don’t expect to make profits .

SEB has long argued that government needs to increase investment in a series of areas. Surely, the government’s plans to increase investment in infrastructure should be welcome? But the government’s planned increase amounts to less than £3.8bn spread over four years, or less than 0.1% of GDP in each year. In addition, most of the wish list for infrastructure and capital projects is dependent on investment in the private sector. So, George Osborne and Boris Johnson stood outside Battersea power station in London and talks of new tube lines, enterprise zones and 25,000 jobs. Just two days later the private developer central to the project collapsed into receivership.

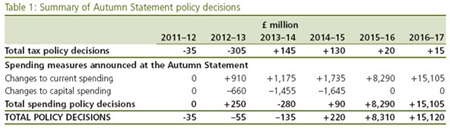

Worse, the government’s planned increase in capital spending is paid for by taking money from the pockets of the poorest and most vulnerable in society. These will bite much harder in later years, long after the pathetically small planned increased in investment has come to an end. This is shown in the table below, from the Autumn Statement.

Table 1

So, there are total cuts in current spending in 2012/13 of £910mn and total cuts over the next 3 years of £3.8bn, shown as a positive sign in the Treasury bookkeeping method. This is in order to pay for tax cuts (fuel duty) and a projected increase in capital spending. But in the two following years the projected cuts to current spending increase dramatically for a total of over £27bn cuts in all. Although these are mostly unspecified, the itemised cuts include child tax credits, working tax credits, real public sector pay cuts and the breaking of the promise to uphold overseas development aid at 0.7%.

This is a very damaging but much milder version of the same logic that has led Greece and Ireland to disaster - every failure to meet budgetary targets because of the impact of ‘austerity’ is met by further ‘austerity’ measures. But the deficit is and borrowing totals are likely to go higher still as the economy stagnates- or worse. It may only be a matter of time before this same logic produces comparably savage cuts in spending- with the same economic consequences.

Politically, by pre-announcing needed cuts for the next Parliament Osborne hopes to bind all parties to further ‘austerity’ measures. For the LibDems, Danny Alexander has already proved obliging, signing up to Tory cuts of £23bn in the next Parliament. The key question is whether Labour will go down the same path in accepting the need for cuts even when they have demonstrably failed to deliver economic growth or even deficit-reduction. It is the path that leads to Athens and must be resisted.

No comments:

Post a Comment